- The current College Football Playoff format creates excessive travel demands for teams and their fans.

- Coaches suggest moving the playoff schedule to December and holding more games on campus sites.

- Playing playoff games at neutral sites has led to low ticket sales and a lack of atmosphere.

MIAMI GARDENS, FL – This is common sense stuff, everyone. If we can see it, they can, too.

Those who have built the College Football Playoff can surely understand they’ve asked Oregon fans to travel cross-country to Miami for the Orange Bowl quarterfinal, fly back to Oregon, and a week later fly cross-country again for the CFP semifinal in Atlanta if the Ducks advance.

Then fly back to Oregon, and 10 days later, fly back to Miami for the national championship game in Atlanta. Or approximately 15,000 miles over three weeks.

Or that No. 1 Indiana’s road is Los Angeles/Atlanta/Miami. Or No. 2 Ohio State’s road is Dallas/Phoenix/Miami.

What in blue blazes is going on here?

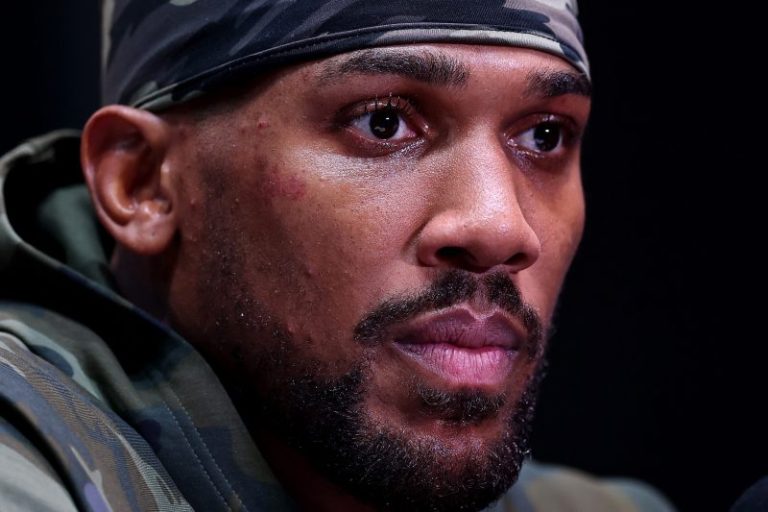

“It’s the craziest thing,” Oregon coach Dan Lanning said. “There’s a better way to do all of this. We’re not inventing the wheel here.”

It’s not that difficult, everyone. Strengthen the standalone December playoff product, and avoid the NFL playoffs a month later.

This brings us all the way back to common sense, and that we’ve been obsessing over the wrong problem all along. It’s not just who earns the right to play in the CFP, it’s the sequencing of it all.

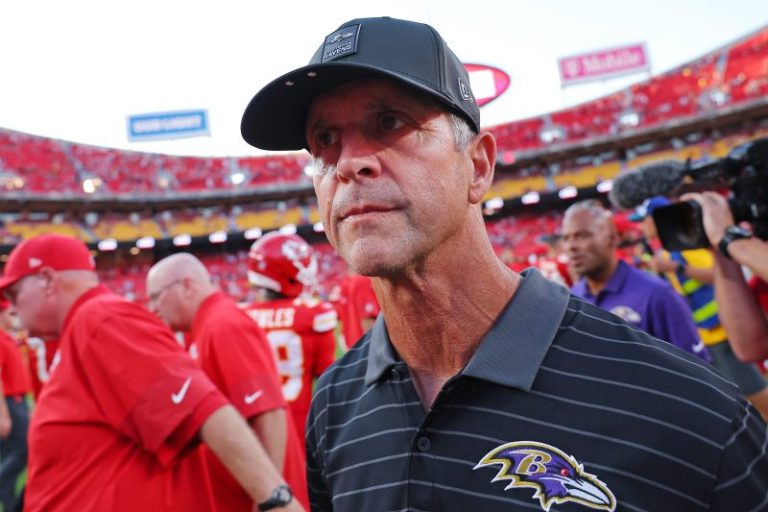

Here’s how Lanning, and Texas Tech coach Joey McGuire — whose teams play Thursday in the Orange Bowl CFP semifinal — think it should all play out.

(A quick addendum: Lanning and McGuire are just meathead football coaches, like many other coaches who see this the same way. What do they know about running a billion-dollar postseason tournament? Leave that to the brilliant university presidents and conference commissioners — who haven’t screwed up a single thing over the past four years of paradigm change.)

The playoff, coaches say, should begin the first weekend of December where Championship Week currently resides. That doesn’t mean eliminating conference championship games (and millions in revenue), it means beginning the season one week early.

A novel concept, I know.

The quarterfinals are then played a week later, or the second Friday and Saturday of December. The semifinals are played a week after that on the third Friday and Saturday of December, and the championship game on New Year’s Day — the holiest of college football days.

Here’s the key: the first three rounds of the tournament are played on campus, thereby maximizing the impact of the regular season — no matter how many teams (12 or 16) you throw into the playoff bracket.

The more you win in the regular season, the greater your opportunity to host playoff games and gain a significant competitive advantage.

And bonus: the convoluted and dysfunctional college football calendar — and the unwieldly player procurement process of national signing day and the opening and closing of the transfer portal — ends. Everything begins after Jan. 1.

“The idea should be to make everything easier for all involved,” McGuire said. “We’re the furthest thing from that right now.”

This isn’t the men’s basketball tournament, a made-for-television neutral site event that emphasizes the underdog. Because the underdog chucking 3-pointers possession after possession can do the unthinkable.

The underdog chucking deep balls play after play in the CFP loses by 30.

It’s a completely different sport and tournament, and absurd to even compare the two. Almost as absurd as Oregon playing Texas Tech in an NFL stadium in the second round of the CFP — instead of Texas Tech rewarded for the greatest season in school history by hosting in the game day asylum that is Lubbock.

“I can’t even imagine what it would be like to have a home playoff game,” said Texas Tech quarterback Behren Morton. “Our fans are wild in the regular season. What would a playoff game look like?”

Like it did in the first round at Norman, Eugene, College Station and Oxford. Wild, never before seen environments.

Or you can have the current quarterfinal landscape, where ticket brokers have scooped up thousands of tickets — and now can’t sell them. The get-in price for the Orange Bowl is $49, and $32 for a Cotton Bowl featuring two of the biggest television properties (Ohio State, Miami) in the sport.

Something, everyone, isn’t working.

It’s bad enough that CFP leaders force the highest-ranked Group of 5 champion on its marquee event, despite the drastic difference in schedule difficulty. They then compounded the problem this year, when the selection committee added a Group of 5 at-large selection.

It’s worse that quarterfinal games — when the tournament truly begins — are struggling to fill stadiums and lacking juice because they’re not on campus. The college football regular season, the greatest television event in sports this side of the NFL, is an ever-growing monster because of rare campus environments.

It makes no sense to take the most important show of the season — the tournament to decide the champion of the sport — and let it play out at neutral sites. It’s not the 1980s and 90s anymore, the golden ring is no longer a major bowl game.

Its now a home playoff game, and all the pomp and parade that goes with it — including Fiddy showing up in Norman, of all places, singing ‘Many Men’ at the end of the third quarter.

I’m tryin’ to be what I’m destined to be… I’m a diamond in the dirt that ain’t been found.

The CFP can no longer avoid tournament change, no longer run from its destiny. Everything else in the sport has drastically changed, why cling to the old postseason?

The bowl season won’t go anywhere, and will be as strong as ever — merely 41(!!) games strong. The Rose Bowl is still the grandaddy of them all, the annual home of the national championship game.

Once the sequencing is figured out, once the idea of emphasizing what makes college football unique and bulletproof is embraced, the thought of adding meaningless Group of 5 charity games to the process becomes utter blasphemy.

Then the real fun begins. Campus games take over, and funnel into the New Year’s Day spectacle of the Rose Bowl.

The college football holy ground.

This post appeared first on USA TODAY